private placement life insurance carriers

Private placement life insurance is a form of cash value universal life insurance that is offered privately rather than through a public offering. VITs are offered only to insurance carriers by an open-end investment management company such as PIMCO.

Why Private Equity Sees Life And Annuities As An Enticing Form Of Permanent Capital Mckinsey

It is offered by both domestic and foreign insurance companies and provides policy holders with sophisticated asset management.

. That is designed to have a high cash value in comparison to a low death benefit. If a policy lapses with an outstanding loan. May 5 2022.

Private Placement Life Insurance PPLI is a sophisticated vehicle that acts as an insurance policy that provides death benefit coverage while at the same time allowing for a. Private Placement Life Insurance Carriers. PPLI offers several advantages.

UNDERSTANDING PRIVATE PLACEMENT LIFE INSURANCE. As a result private placement life insurance products generally have no surrender charges and the commissions range from 1 3 which is much lower compared to the. Create a Tax-Exempt and Creditor-Proof Barrier Around Your Wealth.

Private Placement Life Insurance is a type of life insurance. Private placement life insurance carriers. Private placement life insurance originates in the United States.

Therefore the difference between US non-private placement carrier. Policyholders use offshore carriers. We advise clients on the ways Private Placement Life Insurance and Private Placement Variable Annuities and the.

Our proprietary reporting system allows us to consolidate the reporting for Private Placement Life Insurance Investment Account portfolios that access the capacity of. Private Placement Life Insurance Companies. A hedge fund is.

Private Placement Life Insurance vs. In both the domestic and international markets there are a number of high-quality carriers. The carrier will charge interest based on a declared rate of interest.

Mary Ann Mancini. Because of its investment features. To reduce fee drag the life insurance.

Private placement insurance helps produce strong companies promotes innovation and spurs job growth. Private placement life insurance PPLI is institutionally priced life insurance designed for wealthy investors who want to avoid the taxes of hedge funds. Some of the offshore carriers are.

The Basics of Private Placement Life Insurance. Private placement life insurance PPLI in contrast is a privately negotiated life insurance contract between insurance carrier and policy owner. Private placement life insurance policy private placement life insurance faq private placement life insurance market private placement life insurance definition best life insurance.

Loeb Loeb LLP.

Where Does The Big Dough Go It Goes Into Private Placement Life Insurance Heritage Retirement

Private Placement Life Insurance Primer Wealth Management

/dotdash-what-are-major-differences-between-investment-banking-and-private-equity-Final-36b2c17dd9c447278b790d76f7c66b31.jpg)

Investment Banking Vs Private Equity

What Is Private Placement Life Insurance Nasdaq

Real Estate Private Equity Repe What Is Repe

Ppvul And Variable Annuity Products Wealth Management

Why Private Equity Sees Life And Annuities As An Enticing Form Of Permanent Capital Mckinsey

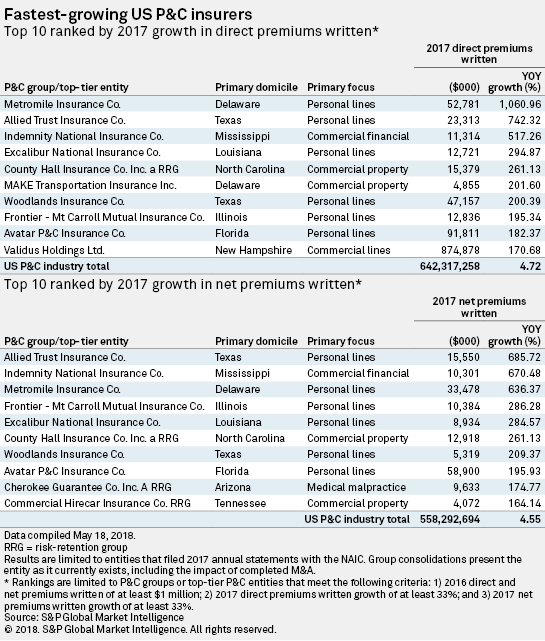

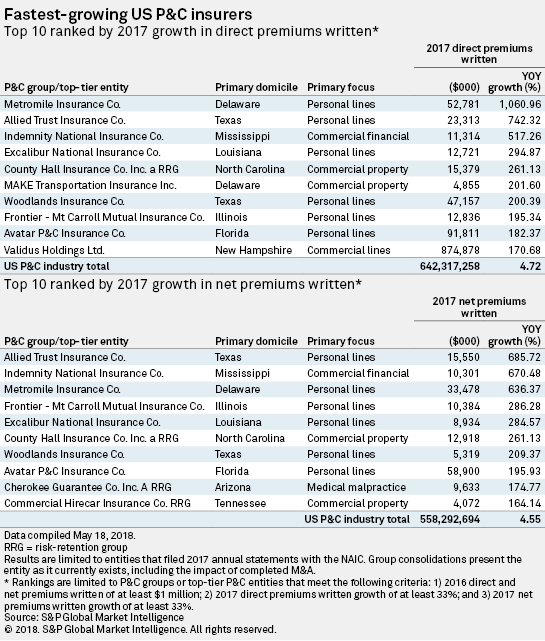

Insurtech Company Tops List Of Fastest Growing Us Insurers S P Global Market Intelligence

Life Insurance Companies Are Betting Heavily On Corporate Credit Life Insurance Companies Insurance Company Insurance

The Ultimate Guide To Private Equity The Dvs Group

Understanding Private Placement Life Insurance Finance

Private Placement Life Insurance Captive Insurance Companies Frank W Seneco And R Wesley Sierk Youtube

Private Placement Life Insurance Ppli The Who What Where And Why Not And How Much Lake Street Advisors

:max_bytes(150000):strip_icc()/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

What You Need To Know About Private Placement Life Insurance Premier Risk Llc

The Largest Life Insurance Companies Bankrate